| Who is it? | Harbinger Capital PartnersHarbinger Capital Partners |

| Birth Place | United States |

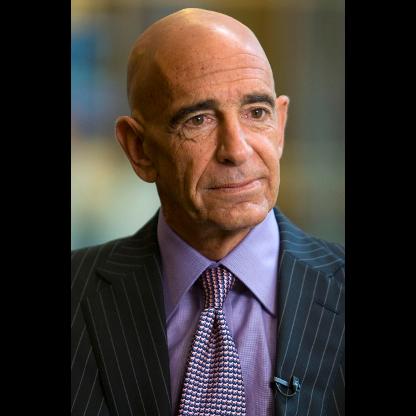

Philip Falcone is a renowned American businessman and investor, best known as the founder of Harbinger Capital Partners. With his exceptional investment strategies and astute decision-making, Falcone has built a significant fortune over the years. His net worth is estimated to soar to an impressive $1 billion by 2024. Through Harbinger Capital Partners, Falcone has successfully navigated the intricacies of the financial market, earning substantial returns for his clients and himself. His exceptional business acumen and ability to identify lucrative investment opportunities have cemented his reputation as a prominent figure in the investment world, making him a true force to be reckoned with.

Philip Falcone grew up in Chisholm, Minnesota with nine siblings in a three-bedroom house. He attended Harvard University on financial aid and graduated with a Bachelor of Arts in Economics in 1984.

In 1985, he started his career at Kidder, Peabody & Co. He also worked at Wachovia. He was also Senior High Yield trader at First Union Capital Markets in Charlotte, North Carolina. From 1990 to 1995, he served as President and CEO of AAB Manufacturing Corporation". He was the head of High Yield trading at Gleacher Natwest from 1997 to 1998, and at Barclays Capital from 1998 to 2000.

Falcone is married with two children, and lives in New York City. In 1997, Falcone married Lisa Velasquez. Lisa grew up in Spanish Harlem and has an associate's degree from Pace University. In 2008, she started a film production company, Everest Entertainment, and she has produced Mother and Child, 127 Hours, and Win Win. She is active in philanthropic causes, including the American Museum of Natural History and sits on the board of the New York City Ballet. In 2009, the couple reportedly donated $10 million to New York City's High Line project. They have twin daughters, Liliana and Carolina (born February 2005).

In 1999, Falcone built a house in Sag Harbor, New York, which he sold in 2005 for $1.57 million.

In 2000, he founded Harbinger Capital with Raymond J. Harbert. In 2008, Falcone became a minority owner of the NHL's Minnesota Wild hockey team when he purchased a 40% stake of the hockey team. Through Harbinger Capital, Falcone and Harbert owned 20% of The New York Times in 2009. That same year, Falcone became its majority owner, though Harbert remained an investor.

In 2008, Falcone bought a house on the Upper East Side, formerly owned by Jeremiah Milbank and later Bob Guccione, for $49 million. Also in 2008, Falcone bought a Saint Barthélemy villa for $39 million.

On June 27, 2012, the U.S. Securities and Exchange Commission filed securities fraud charges against Falcone and Harbinger Capital Partners, alleging that Falcone "used fund assets [of $113.2 million] to pay his taxes, conducted an illegal 'short squeeze' to manipulate bond prices, secretly favored certain customers at the expense of others, and that Harbinger unlawfully bought equity securities in a public offering, after having sold short the same security during a restricted period."

In May 2013, he accepted an SEC settlement in which he and Harbinger agreed to pay a total of $18 million. Under the deal, Falcone would have been banned from operating as an investment advisor for two years. However, in a rare move, the commissioners overruled the enforcement staff and threw out the deal, forcing the two sides back to the bargaining table. Reportedly, SEC chairwoman Mary Jo White felt the deal was too lenient. Finally, on August 19, the SEC and Falcone agreed to a deal in which he and Harbinger admitted breaking the law. It was the first SEC settlement in years in which the defendant was required to admit wrongdoing; usually, defendants who accept SEC settlements neither admit nor deny that they broke the securities laws.

On July 4, 2014, the SEC Office of the Whistleblower rejected a claim made by an individual requesting a reward for assisting in the investigation. The SEC rejected the claim, asserting in the "Claimant did not provide information that led to the successful enforcement".