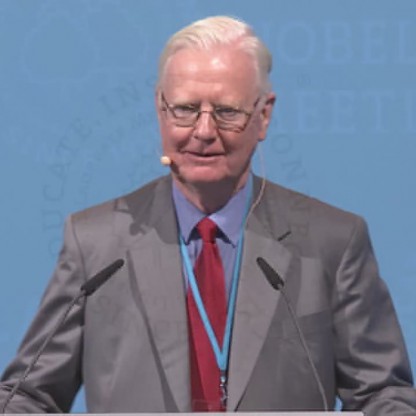

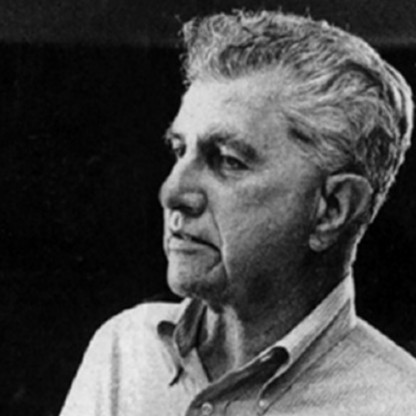

| Who is it? | Economist |

| Birth Day | May 16, 1923 |

| Birth Place | Chicago, Illinois, United States, United States |

| Age | 97 YEARS OLD |

| Died On | 3 June 2000(2000-06-03) (aged 77)\nChicago, Illinois, USA |

| Birth Sign | Gemini |

| Institution | Carnegie Mellon University University of Chicago London School of Economics |

| Field | Economics |

| School or tradition | Chicago School of Economics |

| Alma mater | Johns Hopkins University, (Ph.D.) Harvard University, (M.A.) |

| Doctoral advisor | Fritz Machlup |

| Doctoral students | Eugene Fama William Poole |

| Contributions | Modigliani–Miller theorem |

| Awards | Nobel Memorial Prize in Economic Sciences (1990) |

Merton H. Miller, the renowned economist in the United States, is projected to have a net worth ranging from $100,000 to $1 million in the year 2024. His expertise and contributions to the field of economics have undoubtedly played a significant role in accumulating his wealth. With a career spanning several decades, Miller's innovative research and groundbreaking work, particularly in the field of financial economics and corporate finance, have earned him numerous accolades and recognition. His net worth reflects the impact he has made as an esteemed economist and establishes him as a prominent figure in the world of finance.

Miller was born in Boston, Massachusetts to Jewish parents Sylvia and Joel Miller, a housewife and attorney. He worked during World War II as an Economist in the division of tax research of the Treasury Department, and received a Ph.D. in economics from Johns Hopkins University, 1952. His first academic appointment after receiving his doctorate was Visiting Assistant Lecturer at the London School of Economics.

In 1958, at Carnegie Institute of Technology (now Carnegie Mellon University), he collaborated with his colleague Franco Modigliani on the paper The Cost of Capital, Corporate Finance and the Theory of Investment. This paper urged a fundamental objection to the traditional view of corporate Finance, according to which a corporation can reduce its cost of capital by finding the right debt-to-equity ratio. According to the Modigliani–Miller theorem, on the other hand, there is no right ratio, so corporate managers should seek to minimize tax liability and maximize corporate net wealth, letting the debt ratio chips fall where they will.

Miller was married to Eleanor Miller, who died in 1969. He was survived by his second wife, Katherine Miller, and by three children from his first marriage: Pamela (1952), Margot (1955), and Louise (1958), and two grandsons.

Miller wrote or co-authored eight books. He became a fellow of the Econometric Society in 1975 and was President of the American Finance Association in 1976. He was on the faculty of the University of Chicago's Booth School of Business from 1961 until his retirement in 1993, although he continued teaching at the school for several more years.

He served as a public Director on the Chicago Board of Trade 1983–85 and the Chicago Mercantile Exchange from 1990 until his death in Chicago on June 3, 2000. In 1993, Miller waded into the controversy surrounding $2 billion in trading losses by what was characterized as a rogue futures trader at a subsidiary of Metallgesellschaft, arguing in the Wall Street Journal that management of the subsidiary was to blame for panicking and liquidating the position too early. In 1995, Miller was engaged by Nasdaq to rebut allegations of price fixing.