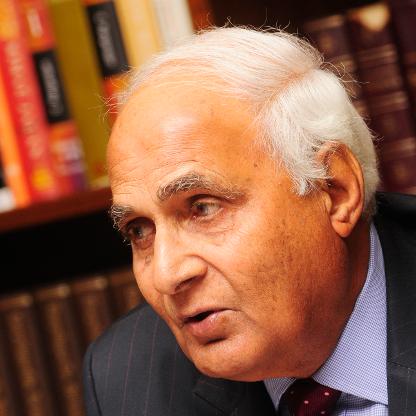

Itoyama has served four terms as a member of the Diet, the Japanese Parliament with nearly twenty years of active involvement in the ruling party, the Liberal Democratic Party. He was a principal figure in a 1974 bribery scandal that resulted in the arrests of more than 90 people, including a senior vice President of Itoyama's company, and Peter Herzog characterized Itoyama as "one of the worst offenders" in having a "cavalier attitude" toward Japanese election laws.