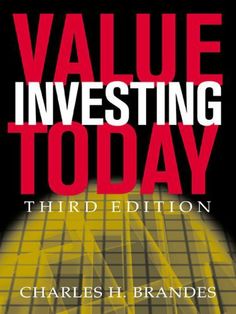

Brandes' adherence to Graham and Dodd principles has extended to investment research. He commissioned a study to investigate the "Falling Knives" strategy, the investment axiom that catching falling knives (a stock whose price has been dropping precipetously) is like catching falling money (likely to lead to losses). Researching 1,000 companies between 1986 and 2002 whose price had fallen 60% over a twelve-month period, the study found that within three years of the decline 13% of the companies went bankrupt, but despite this that the portfolio as a whole gained in value by 18% over three years. Announced departure from the firm effect February 26, 2018. Brandes published a well received book on his investment strategies in 2003 titled Value Investing Today (McGraw-Hill, ISBN 0-07-141738-9).